Industry News

Europe Needs Over €1.8 Trillion Investment in Energy Infrastructure by 2035

(Bureau of Foreign Trade, Ministry of Economic Affairs 2025.09.04)

To bridge the global infrastructure gap, an annual investment equivalent to 3.5% of global GDP, approximately €10.5 trillion, will be required by 2035. Of this, around €7 trillion is earmarked for developing markets, while Europe must significantly increase its infrastructure investments to achieve its climate and digital transformation goals. According to Allianz Trade's latest report, "3.5% to 2035, Bridging the Global Infrastructure Gap," Europe's decarbonization pathway necessitates an annual investment of approximately €100 billion to €137 billion for grid modernization, enhancing energy storage efficiency, and strengthening cross-border power grids.

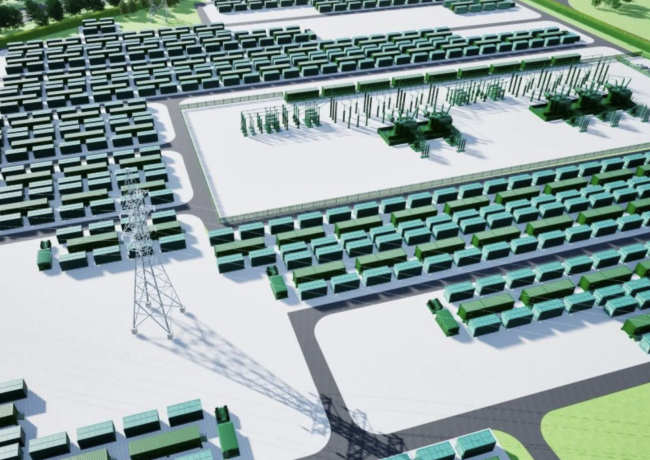

By 2035, Europe will need to invest over €1.8 trillion in energy infrastructure, with 70% of this funding allocated to power grids and energy storage systems. Germany is projected to become a key energy hub in Europe, with anticipated investments exceeding €68 billion in battery storage. Italy is expected to require investments of €17.5 billion in storage facilities and €6.3 billion in cross-border electricity interconnections. For non-energy infrastructure, Germany, France, the UK, Spain, and Italy combined will need to invest at least €500 billion. Italy's infrastructure needs, including roads, railways, ports, telecommunications, and water networks, will exceed €90 billion by 2035.

Complex bureaucratic procedures, delayed permit processes, and low local administrative efficiency are the main obstacles to infrastructure development in Italy. In recent years, Italy has repeatedly revised its National Recovery and Resilience Plan (PNRR) and engaged in further discussions with the EU to simplify regulations. These improvements are crucial to ensuring the timely receipt of EU funds; otherwise, Italy risks losing up to €54 billion in available funds before August 2026.

As of 2024, the total value of infrastructure assets supported by private capital has reached €1.35 trillion, concentrated in areas such as clean energy, data centers, and sustainable transportation. The estimated annual return rate is between 8% and 10%, making infrastructure a highly valued asset class for institutional investors. Future success will depend on establishing a positive cooperative cycle between public and private capital; governments must act as catalysts by setting clear goals, providing guarantees, and reducing risks, while the private sector will contribute funding and provide technical and management expertise.